Welcome to The Dealmaker’s Academy and our ultimate guide on how to buy a business in 2019 and growing your company via acquisition.

This really is the ultimate guide to mergers and acquisitions with over 35,000 words covering everything you’ll ever need to know in order to find, fund and flip businesses for profit.

Looking for a specific answers to your questions?

Review the table of contents to find what you’re looking for.

We’ll be covering everything there is to know about being a Dealmaker, how to value a business, the due diligence process and sourcing opportunities.

BUY A BUSINESS – PART ONE

What Is A Dealmaker?

A dealmaker buys a business often at below market value.

As a dealmaker, you never invest your own money because you don’t need to.

You fix the business you buy by making some very, very simple changes. You don’t necessarily have to make the changes yourself.

Often your management team will make them for you.

You generate cash from the business for yourself every month.

In other words, you are paid a monthly consultant’s fee by each of the businesses you own. Your goal is to sell the business for a big payday.

A dealmaker is not a business operator, which is what I call most business owners.

Business operators think they own the business when really the business owns them.

A dealmaker, by comparison, is an investor in a business.

Most business operators have a big payday perhaps once in their lives. A dealmaker can have many big paydays thanks to the fact he or she owns a portfolio of businesses.

Dealmakers also tend to have a lot of fun.

Far more fun than business operators who are mired down with running their businesses on a daily basis.

So much so that they’re often the person who unlocks the office in the morning, does the photocopying, changes the printer cartridge, speaks with the customers, deals with the suppliers and has all the hassle.

I’m going to show you how to buy a business without the need for all the stress and the heartache.

How to Value A Business

Discover how brokers, owners and accountants value a business.

How do you value a business you want to buy and how do you avoid getting it wrong?

Let’s imagine you’re in a situation where you’re interested in a business, and you get to the point of thinking, “Okay, well how much do I pay for this business? What is the value of the business?”

Firstly, there’s a distinction between what you pay for something and its value.

Now if the value is higher than what you pay, then you’ve got a great deal, but if the value is below what you pay, then you haven’t got a good deal.

You don’t want to overpay. No one’s concerned about underpaying, but you don’t want to overpay.

There are several ways to value a business you want to buy. The first way is through a business broker.

Business Brokers

Business brokers fall into two camps. The first will try to get you to go first and place a value on the business.

There’s a rule in negotiating which is the person who speaks first is the person who loses.

You might say the business is worth £100,000, but five minutes later someone else will say it’s worth £500,000.

Of course, the savvy business broker will want to talk to the person who valued it at £500,000.

The second type of business broker advertises the price of the business.

They do their client a massive disservice this way.

It’s a real shame that they do it because it really says, “This is the maximum price that will be accepted.”

Let’s say the business is valued at £100,000.

Everyone who looks at that price will think to themselves, “Well I’m not going to pay a penny more than £100,000, and I’ll probably end up paying less than three-quarters of that number.”

It’s a little bit like when a house is advertised for sale at a certain price.

You immediately discount it and think, “Well that’s clearly the top money that they’re expecting.”

Sometimes the house seller will add, “Or near offer” and you immediately decide you won’t pay the advertised price.

Business brokers fall into those two camps.

Either they don’t have a price attached to the business, and they want you to put forward a figure first, or they put a price next to the business.

You should avoid placing a value on the business because doing so will put you in a very weak negotiating position.

Instead, you should look for a business that has a value attached to it because it puts you in a very strong negotiating position.

The second way of valuing a business comes from accountants.

Accountants

An accountant values a business by looking at the net profit and then multiplying it by a number which is called ‘the multiple’.

I met someone the other day who’s buying a business at 1.5 times net profit, and that’s quite decent in that it’s a low number. An average multiple might be five or six.

When you get into double-digits, it starts to feel a bit like the 1980s when valuations were off the charts.

The third way of valuing a business comes from the business owners.

Business Owners

Let’s say you’re dealing with the business owner directly which, if you’ve done any of my training, you’ll know is the preferred route.

You don’t want to be the first person to mention value.

Instead, you need to find out how the business owner values the business.

I’m interested in what the business owner thinks it’s worth.

I like to get the answer to this question when I have established some rapport with the owner.

It might not happen during the first meeting, which usually happens on the telephone.

The second meeting is often face-to-face, and it’s typically during that meeting when you establish rapport with the owner because you can observe their body language.

I don’t like talking about the price on the phone.

I leave that conversation until I meet with the business owner face-to-face.

Then I say, “So you have a business that you’ve been running for a while.

You’ve told me the good parts of the business.

You’ve told me the parts of the business that you feel could be improved. You must have some concept of value? What sort of number are you looking at?”

Then I shut up and let the owner do the talking.

Occasionally, you will meet a savvy business owner who will say, “I’m not going to give you a value, it’s down to you.”

I respond by saying something like, “Well, in fairness, you’re the one who’s selling.

When you go into a shop, you see the prices on everything. It’s not up to the customer to decide the price of the baked beans so really, I think you need to put a value on the business. You must have some concept.”

Some business owners will refuse to give a number.

If that happens, I say, “Okay, let’s approach this from a different angle. What would be the highest and what would be the lowest? Give me a range.”

Asking for a range is a clever thing to do because when they give you the lowest and the highest number, you can decide not to pay a penny more than the lowest number.

The owner might say, “Well, I think it’s between £100,000 and £200,000.”

As soon as the words “a hundred thousand pounds” leaves their lips, I know that I’m never going to pay a penny more than £100,000.

This happens at a very early stage in the purchase process.

You won’t have done any due diligence or got to Heads of Terms.

You’re just talking. It’s the second conversation you’ve had with the person, and you’re just talking loosely about value.

If the business owner says, “I put the value between £100,000 and £200,000” I then ask, “So, if you were to make £100,000 on this deal, does that mean you would be happy?” The savvy business owner might say, “No, I wouldn’t be happy. Maybe I could get a better deal.”

I say, “Okay, well let’s talk about the other things that are important to you.

What other things in this deal are important to you? What are the other must-haves?”

The owner might say, “I don’t want the van that’s parked outside to be part of the deal. I want to be able to use that van for my new business.”

I’d then question the owner further to discover the things that are important to them.

That’s things like the timing of the deal. I never use the word ‘speed’ because that makes an owner suspect you’re trying to push him or her to hurry so you can get a better deal.

Instead, I ask, “What are the timings? Is there a point at which you want to get this deal done by?” Quite often people will say they want the deal done before the summer holidays or Christmas or New Year or their birthday.

I don’t like looking at numbers at the early stages because I want the number to be emotional and I want to get emotional buy-in on what the value is.

Once we have the emotional buy-in, we can start to use logic to reduce the value and price that we’re going to pay.

Let’s say the value the seller placed on the business was £100,000. I wouldn’t be critical of that value at the early stage of the deal.

I’d just ask, “Tell me how you’ve reached that valuation?”

They might tell you some more personal things. For example, they might say, “I have £20,000 worth of credit card debt, and it will clear that.

I owe £20,000 to my brother, and it will clear that.

I have tax to pay on that £100,000. I’m going to clear about £50,000 which will pay for a holiday and give me a little bit of money to start a new business.”

When you come to the due diligence part of the process, and you discover there’s a tax bill of £10,000 that hasn’t been paid, you’ll say, “You do realise that has to come off the asking price, simply because we can’t pay the tax bill on money that you’ve received and benefited from?

That just wouldn’t be fair, would it?”

You chip away at the price. You’re not too aggressive about it, but you don’t want to pay someone else’s tax bill.

Or you might discover that the deal, which is set to be done on the 29th day of the month, will happen one day before all the staff are supposed to be paid. That will be for the work they’ve done in the previous four weeks.

Quite clearly, it wouldn’t be fair for you to pay staff for the work that they’ve done for the previous owner, so your calculation needs to be adjusted for that.

So, when it comes to value and pricing, one size doesn’t fit all. You need to take lots of different factors into account.

The First Questions To Ask A Seller

When you buy a business, knowing the right questions to ask a seller is crucial to your success as a dealmaker.

After you’ve introduced yourself and exchanged pleasantries, the first question to ask the seller is if they can tell you about the business.

If they aren’t particularly forthcoming, you can encourage them to open up by asking when the business was started.

You can follow that up with, ‘What motivated you to start the business?’

Then ask the seller to tell you about their business background.

Listen very carefully to what the seller tells you.

The more you can find out at the beginning, the better.

It’s better to discover as much as you can in this first telephone call before you invest time in a face-to-face meeting.

We don’t want you to leave your living room or office until you know that there’s a level of interest in it for you that makes it worth pursuing.

To find out more, ask “Just out of curiosity, what prompted you to call me today?” Think of yourself as a non-threatening detective seeking information.

Ask open-ended questions and listen carefully to what the seller says.

The question, “What prompted you to call me today” will reveal the seller’s motivation. He might say,

“My wife told me to call you.”

“Really? Why was that?”

“Well, she’s been saying for years I need to retire, and I spend too much time at the office, and it got to the point where I agreed that, yes, I do spend too much time at the office and I need to do something about it.”

“That’s very interesting. So you’ve been having this conversation for quite a while, have you?”

“Well, yes, it is.”

“It’s got to the point where you need to do something about it?”

“Yes, absolutely.”

Sometimes people say, “It’s serendipity! I was thinking about selling the business or leaving the business, and then your letter arrived.”

The arrival of your letter will be a genuine coincidence, but people sometimes will take it to be a message or a sign, depending on their belief system.

The question you must ask is “Who owns the company and in what percentages?” It’s important to know who is in control of the business and if you’re talking with the right person.

You have to qualify the person with whom you’re speaking.

Brokers do the same thing when they ask you to provide proof of funding: they’re qualifying you.

You need to speak with the person who has the authority to sell the business.

If the seller tells you he or she has partners, ask if the partners are aware of the conversation you’re having.

If you’re speaking to a 20% shareholder, for example, who reveals the other partners don’t know about the conversation, then there’s something wrong.

Of course, the ideal scenario is to deal with one owner.

That’s because he or she will have the authority to make decisions.

You’ll avoid the situation in which one shareholder is keener than others to exit the business.

So, there are the first few questions to ask a seller. We’ll cover more later on.

How To Sell A Company For £70 million

An Interview With Neville Wright

The co-founders of the retailer Kiddicare, Neville and Marilyn Wright, sold their company to supermarket giant Morrisons for £70 million in the midst of the most recent recession. At the time, it was a world record sale price for an independent baby nursery shop. Neville reveals how the deal was done.

“We did the due diligence on ourselves so that people could look at it, examine it and they wouldn’t have to do it themselves, so it cut a lot of time out. It seemed expensive because we were investing in something that we didn’t know whether we’d get any bids for.”

At the time, 11 private equity companies were interested in buying Kiddicare, but Neville says he wasn’t interested in selling to them.

Two years earlier, a private equity company had approached Neville with an offer. Valuing the company at £40 million, they offered £15 million in cash and for £25 million to be kept in the business. However, Neville discovered the prospective buyer wanted to put a £15 million debt on the business.

“Also, they said, ‘This business will sell in three years’ time for £120 million.’ I asked, ‘How are you going to do that?’ They said, ‘We’re not. You are.’”

Neville rejected their offer, which would have meant he was kept on to grow the business on the buyer’s behalf then make a profit after a secondary buyout three years later.

“I didn’t want that.”

Other prospective buyers appeared with offers between £40 million and £50 million, but they too had fallen by the wayside.

By 2011, the UK retail sector was reeling from the recession. Despite this, Neville was looking for a way to take his company to the £200 million mark.

“The whole of the high street was in turmoil. They were falling like a pack of cards. We were trying to decide whether we should become a hunter and look for acquisitions we could bolt on to get the value up to £200 million.

“One day I thought, ‘This is too much. We’ve been in it 34 years. Retail is getting harder, so why not become the hunted?’ Everybody else was hunting for bolt-on acquisitions to keep their business alive, so that’s what we offered. That’s the reason why we put it on the market because it was the easiest and the most profitable thing to do.”

The accountancy firm, Grant Thornton UK LLP, then put the business on the market, and it attracted seven bids. The bids were all about the same value, remembers Neville.

The seven buyers wanted the company for different reasons, he says.

“I felt sorry for some because it was rumoured that they were all spending about £2 million on the due diligence and everything else. The seven were allowed access to the data room. It was then a race to see which one could complete.

“It was about a month for the data room, and on January 29 we decided who we were going to sell it to, and the deal was completed on February 14, so it was very quick.”

Key Addresses For Dealmakers

The following addresses should be in every dealmaker’s address book.

You can get some details about a company for free, including:

- Company information, for example registered address and date of incorporation

- Current and resigned officers

- Document images

- Mortgage charge data

- Previous company names

- Insolvency information

- You can also set up free email alerts to tell you when a company updates its details (for example, a change of director or address).

- You can access more detailed information for a fee.

The report has the UK’s most comprehensive online database for distressed business.

It lists UK companies that fall into administration, liquidation and have winding up petitions lodged against them.

The online database is updated daily with new distressed listings and members are notified of new distressed businesses via daily email alerts.

To get access, you will need to sign-up to become a member,

The Federation of Business Brokers UK

Members offer free no obligation and realistic business valuations.

Information and resources for business owners who want to grow their business quickly through acquisition.

The Academy offers free podcasts as well as Discovery Days and a 12-month Mergers and Acquisitions Programme.

As a DMA member you receive thousands of pounds of advice and guidance every month that will help you avoid making costly mistakes — The Dealmaker’s Academy Membership will be your companion on your business buying journey!

You also receive access for a monthly webinar and a membership newsletter, jam-packed with vital information to guide you on your dealmaking journey.

How To Get The Right Staff For The Business You’re Buying

When you buy a business you need a great team of people to run it, but where do you find them?

Let’s assume that the business that you’re buying already has staff in place and that some of them do a brilliant job and some of them do a not so brilliant job, just like in every business.

When you’re looking at the staff that you inherit as part of the business, what you’re really looking for is a manager.

There might be a manager in place, but if there isn’t, you’ll need to find one who can run the business to replace the exiting owner.

Look For A Great Manager

That manager maybe someone who’s been in the business for a long time and who knows it inside out.

Maybe they’ve got more ambition than the exiting owner.

He or she might say to you, “Look, there are a dozen things we could do with this company.

John the last owner didn’t really push it very hard. I think he was tired and frustrated. He didn’t want to stay in the business anymore.

He just had enough of it, so he never did any of these things.”

You say, “Great job, let’s create a 12-week plan of all the things that you’re going to do and a bonus structure so that when you make these things happen you get a bonus.”

Occasionally I bring in someone from the outside like a manager who’s worked with me on other deals and say to him, “Run this business for me, and when we sell it you’re going to have five percent of the sales process.”

That gives the manager a great incentive to create the changes you want.

The manager I use is someone I trust.

He sends me email updates once a week and sits with me once a month at a board meeting where we discuss what’s been happening.

He’s my right-hand man.

But I think that nine times out of 10, the right staff are in the business already.

You’ve just got to find them.

You need to identify the people who are ambitious then you’ve got to nurture them, give them a goal, work out a plan of action and motivate them to go and do it.

This is all about nurturing the talent within the business and letting them run with it and make it more successful for you.

How To Prepare For The Sale Of Your Business

To make the sale process as smooth as possible, gather all the information that prospective buyers will want to see, including financials, paperwork, legal documents and contracts.

The more organised you appear the more confidence prospective buyers will have in you and the business.

What Documents Do You Need

Prospective buyers will want to see paper-based evidence that your claims about the value of your business based on profit and loss figures, assets, contracts and other details are accurate.

Financials

To gauge the level that the business is operating at, how profitable it is and whether it has debts, prospective buyers will want to see financial figures including profit and loss accounts from the past three years as well as up-to-date balance sheets.

Assets

You’ll need to prepare a written list of all the business’ assets including properties, equipment, IT systems, vehicles, and so on.

Contracts

You’ll also need to provide a list of contracts for clients, employees, suppliers and contractors.

Key Processes

If the business’ success is due to outstanding systems, describe them.

Information Memorandum

An information memorandum is a comprehensive document that is created to highlight ALL the vital information required for the sale of your business.

This document will be shown to prospective buyers after they have reviewed a summary sheet and have signed a confidentiality agreement.

It must be appealing to prospective buyers yet factually accurate, clear and concise.

How Do You Get Financing For A Business You Don’t Yet Own?

There is often an assumption that the only way to buy a business is to use your own money or borrow it from somewhere, usually a bank or a relative.

That’s the exact opposite of what I tell people to do.

I advise against borrowing from a bank, taking out a second mortgage or releasing equity from your home, or signing a personal guarantee.

I recommend you approach this with a different mindset.

Distressed Businesses

When you buy a business that has problems and issues, and the business owner just wants to get rid of it.

You see opportunity, and you see that with some simple changes you can turn it from a business that is a nightmare for the current owner into a business that is wonderful for you.

When you see a business with problems, the payment you should make for it and for solving the business owner’s problems is £1.

If I buy a business with problems, I don’t expect to pay a penny for it.

I bought a business with annual revenue of £4.7 million for £1.

Can you buy a £100,000 a year business for one pound? Of course you can.

Can you buy a £1 million business for a pound? Yes, you can.

Can you buy a £100 million a year business for a pound?

Absolutely. There are plenty of examples of this.

So if it’s a distressed business, that is, a business in trouble, you don’t need financing because you’re not going to pay anything for it.

Let’s say you’re talking to a business owner who wants £100,000 for the business.

Deferred Consideration

During the due diligence process, you find that there’s some tax that hasn’t been paid, some staff that haven’t been paid, bonuses that haven’t been paid, and bills that haven’t been paid.

The total outstanding amount is £20,000. That reduces the £100,000 down to £80,000.

So now the price that we agree to is £80,000.

You need to discuss the terms with the owner because he is probably assuming that he’s just going to walk off into the sunset with £80,000 tucked into his pocket and that he’ll never have to think about the business again.

Now that’s what a lot of business owners initially think.

However, they discover very, very quickly that very few buyers are going to do that regardless of the amount of money that they have.

They might have a lot of money in the bank, but they’re not going to go and spend a lump sum on a business.

That’s because buying a business has a degree of risk and they don’t want to invest a lump sum upfront. Instead, they pay for it in instalments.

So, you should suggest to the owner that you pay the £80,000 over time.

It might be 12 months, 24 months, 36 months, 48 months, maybe even, 60 months. It really depends upon your due diligence.

Now, remember due diligence is the checking that you carry out on a business before you buy it. It’s like the survey or the valuation report that you get done on a property before you buy it.

You check that the business can support several things. First, it can support the repayments to the former business owner, whatever they might be per month over whatever time period and, secondly, that it can support payments to you.

Remember, you should be paid out of the business every month as well.

I’m not an accountant, and I don’t give accountancy advice, but I have due diligence people who carry out those checks for me. So they work out that I can pay the business owner over whatever time period.

With this structure, you win and the business owner wins.

Asset Finance

But what if the company you want to buy has some assets.

Let’s say there’s still some payments left to be made.

In that situation, you can use something called, ‘Asset Finance’, so you get an asset finance broker—and I’ve got a wonderful asset finance broker who works with the members of our Mergers & Acquisition Programme—to refinance the assets and pay off the old finance.

The difference between the two will be yours.

It’s a little bit like re-mortgaging a property.

When you re-mortgage a property, you pay off the old mortgage.

You’re refinance at the current value of the property.

You pay off the old mortgage, and if the old mortgage is paid off and there’s a difference, that money is yours.

You can do several things with the money when you refinance the assets in the business.

You can use it as working capital, so you can pay for an advertising campaign to boost sales. You can use it to hire some additional staff.

You can use it to pay for anything that’s going to make the business more successful.

If the business has struggled with cash, this is a good way of releasing cash.

Don’t worry that you’ll overstretch yourself because the finance broker will never finance something that the business can’t afford to pay back.

Of course, the finance broker will take into account the amount you’ll pay the owner and the amount you’ll withdraw every month as a consultant’s fee.

You can use the money to pay the business owner. Let’s say that your refinance of the assets releases £80,000.

You could use £80,000 to pay the business owner in full. I wouldn’t recommend it, but you could do it.

You could also use part of that lump sum to pay the business owner to reduce the payments you’ll be making over coming months.

So you’d still be paying the business owner over an extended period but you will have reduced the amount of those monthly payments.

You could also use the money that you release from the refinancing of the assets—and this is my preferred option—to pay yourself.

Think about it: you’ll have spent the previous 12 or 16 weeks negotiating the deal with the business owner.

You’ll have had numerous meetings and telephone calls in that time. You’ll have sent numerous emails. But you haven’t been paid.

How Do You Get Paid?

When you buy a business you get paid with a deal fee.

Here’s how that works:

Let’s say you refinance the assets, and it releases £80,000 in cash. You can now take that £80,000 as a ‘deal fee’.

That is what people get paid for putting a deal together.

It happens in the private equity world on every single deal.

Now you are a private equity company, so why don’t you put together a package where you pay yourself?

In this scenario, you’d be £80,000 better off.

I think you’ll agree that £80,000 is a very good return on your time investment.

Someone I know refinanced the assets and released £7 million in cash and that £7 million, of course, was the deal fee that went back to the people who’d put the deal together.

Why You Should Never Accept A Seller’s Assurances

Most business owners will spin you stories about how profitable and successful their business is but it’s a mistake to believe everything they say.

You should never accept what business owners tell you about their company because they will naturally gloss over the less desirable aspects of the business.

An accountant recently described how one seller tried to make out the business was so successful that he didn’t have to do any work or make any effort.

When the accountant and the dealmaker asked for a 9 am meeting, the seller said, “Oh don’t come at nine o’clock: I don’t get in until 11.”

When they met the seller at the appointed time, he was sitting at a desk devoid of any papers. He didn’t even have a PC or laptop.

The only thing on his desk was a newspaper. A horse racing programme played on a TV.

“It was so funny,” the accountant told me. “He was trying so hard to create the impression that his business required no effort to run.”

The dealmaker really wanted to buy the business, but the accountant’s suspicions were aroused. He investigated and didn’t like what he found. He advised against the purchase, much to the annoyance of the dealmaker.

But his suspicions were well-placed: the business was sold to someone else and, three months after the purchase, it went into liquidation.

That’s why you should take what a seller tells you with a pinch of salt. Always investigate.

How To Get What You Want From A Deal

An insolvency expert reveals how you can buy the assets of a company and leave the shares.

When you buy a business, you have a choice between buying the shares and buying the assets.

When you buy the assets, you can select which ones you want to acquire.

The starting position and obligation of an insolvency practitioner (IP) is to realise the assets for the creditors.

It’s fair to say that the starting point is to try and sell the whole business as a going concern, if possible, because that will get the greatest realisation, but, if we’re doing a liquidation, the business is actually shut, or there are no bidders then the next best thing is to sell the assets on a break-up basis.

With the business sale as a going concern, there are VAT benefits for you, but if that’s not an option, then you might decide to buy the plant and equipment but not the goodwill.

In digital marketing, you might want the database, but not the whole business, so you can cherry-pick.

In a situation where the administrator, or the liquidator, is looking to sell whatever he can, you can cherry-pick the best bits and put bids in for those.

Equally, you can cherry-pick for different sites, so, if you are just concentrating on the north of England, for example, you can make a bid for those.

It will all depend on where the liquidator or administrator is in the process.

In the very, very early days of the insolvency, the administrator, or the liquidator, will be looking to sell off the whole thing as a going concern.

The issue when you’re selling a business is to mitigate the liabilities.

Let’s say you have TUPE in terms of staff, and if you’re looking at the return to creditors, and the overall deficit position, by offloading the staff in a sale as going concern, then you’re offloading future liabilities, in terms of redundancy, pay in lieu of notice, so they transfer off.

If you buy the whole business, you could be liable for TUPE.

That’s about transferring staff from one entity to an existing or a new entity.

Hire an HR professional to take care of it for you.

If you try to do it yourself it is likely to go wrong.

The Difference Between A Share Sale And An Asset Sale

In any sale, distressed or otherwise, you can buy the shares or the assets of the target company.

If you buy the shares, you’re taking on the problems the company may have experienced.

There are tax benefits in buying shares, such as entrepreneurs’ relief, but, if you do buy the shares, you’re buying everything that goes with it, warts and all.

One reason to consider a share purchase is where you have contracts or registrations that are peculiar to the company itself.

Sometimes they aren’t easily transferrable.

I’ve done one recently in which the business had an EU grant along with intellectual property.

While I went in as an administrator, I was selling the shares as a subsidiary because moving the EU grant would have been too complicated.

If you’re buying just the assets you’re not necessarily buying any problems that go with it.

Secured creditors, et cetera, are exceptions, but, broadly speaking, that is the difference.

If you’re looking at a company with financial problems but which isn’t yet in insolvency, you might want to put the company through an insolvency process, just to make sure that you don’t end up with all the problems.

BUY A BUSINESS – PART 2

In this section of our ultimate guide on how to buy a business, you’ll discover the following key insights and ideas that will take your acquisition strategy to the next level:

- Where to find businesses to buy

- More crucial questions to ask a business owner in your first conversation

- Key negotiating skills every dealmaker needs to develop

- The expert advisers you need for every deal

- The hard lessons former Kiddicare founder Neville Wright learnt from the £70mln sale of his company

- The traits of a great dealmaker

- The Rule of Six

- How to put the right corporate structure in place

Only one in five businesses that are sold are advertised.

For that reason, you should take the initiative and seek out prospective sellers rather than relying on finding them through adverts.

Approach Business Brokers

There are advantages and disadvantages to using a broker to source businesses that are up for sale.

On the plus side, brokers are already working with willing sellers.

They’re also likely to have comprehensive details about any business that’s up for sale.

This will speed up the buying process because you won’t have to wait while the seller compiles the information you need.

However, there’s a risk that the broker will have inflated the seller’s expectations in the same way that real estate agents tend to do with property owners.

There is also a strong possibility that to get the best price for their client (the seller), they will encourage you to get into a bidding war.

A broker is also likely to want you to pay 100% of the purchase price at the point of sale.

There are plenty of ways to find businesses for sale without resorting to brokers or looking at adverts.

They include:

Word Of Mouth

Talk to your personal and professional network.

Clients

Your existing clients or suppliers may also know people who could be persuaded to sell their business to you.

Let them know the kind of business you’re interested in and in which sector.

Pitching To Competitors

Arrange meetings with competitors and suggest that your two companies merge.

Web Listings

There are online directories that list businesses for sale like www.rightbiz.co.uk.

Find one that specialises in your chosen sector.

Direct Marketing

Buy or build a database that has the names and physical addresses of business owners in the specific sector you’re targeting.

Write a personal letter.

Explain that you’re a private investor and share your motive for wanting to buy businesses in their sector.

Advertising

Place adverts in publications that serve your sector.

Your advert can say something like, ‘Private investor seeking new business opportunity.

Contact [your email] for more information.’

Search Engine Ads

Advertise on the major search engines like Google or Bing to attract willing sellers.

You’ll need to invest in PPC advertising and have a landing page where sellers can enter their contact details.

Display Ads

You can attract the interest of willing sellers by using Display Ads on platforms such as LinkedIn, Google and Facebook.

Organic Social Media

Write brief posts on social media platforms such as:

This will let people know that you’re looking for businesses to buy.

I put a post on LinkedIn recently about how I was looking for businesses to buy in the children’s nursery sector and received 17 responses.

You need to keep posting.

The more often people see your posts, the more likely they are to respond to them.

Trade Shows

Visit trade shows in your target sector.

Use it as an opportunity to contact business owners.

Let them know you’re interested in buying profitable or distressed companies.

Other Dealmakers

Get to know other dealmakers and let them know the sector you’re looking at, and what kind of businesses you’re interested in buying.

Partnering

Form a partnership with another dealmaker.

Deal Swapping

Swap deals with other dealmakers.

After all, a deal you don’t want might be someone else’s ‘dream deal’.

Adminitrators

There are a few drawbacks to going through administrators.

You won’t be able to carry out due diligence on the purchase so you’ll be buying the assets ‘sight unseen’ and will probably have to make a blind bid.

The First Questions To Ask A Seller

Your first conversation with a seller is critical, and you must use it as an opportunity to discover key information about the business and the seller.

Here are three more questions that you need to ask a seller when you speak to a business owner on the phone for the very first time.

Let’s say there is more than one shareholder or decision maker. Ask, “Is it possible that we get everyone together at the same time?” Quite often, it will turn out that one shareholder is based in Dubai and another is based in South Africa. It makes arranging a group phone call difficult.

Now, it still might be worth pursuing a business with multiple owners but, compared with one that has a single owner, it will be more complicated.

A good question to ask is, “What is the name of the limited company?” The person you’re speaking with might just have given you the trading name.

You need the limited company name so that you can research it at Companies House.

There you can find out who the owners are and who’s in control. You can get an idea of charges over the company.

Once you’ve discovered what companies have a charge over the company you can return to the seller to find out more details. You can also see if they are invoice discounting, or factoring in some way because that company will have a charge over the business.

You should also ask, “Do you own any other businesses?” or “Is this the only business you’re thinking of disposing?” You might discover that XYZ Limited is one of six companies.

You may then be able to buy more than one business.

Disposing is a very good word to use instead of selling.

That’s because selling conjures up images of pound signs, whereas disposing implies shoving their problems over to you!

If you use the term ‘selling’, you’re putting the idea in a seller’s mind that there’s going to be a lot of money changing hands.

It will give them the idea it’s a big transaction.

Using the right language does make a difference.

Another very important question to ask is, “Are there any family members involved?” The ideal scenario is where there are no relatives involved in the business.

It will mean you don’t have to deal with family dynamics.

Buying a family-run business can be more complicated than usual because you may have to counsel family members through the process to ensure everyone’s happy.

Key Negotiating Skills Every Dealmaker Needs

Jonathan Jay shares negotiation skills that have been incredibly effective when negotiating the purchase of a business from its owner.

Start by initiating the NDA, the non-disclosure agreement.

There’s a chance your seller won’t have a clue what that is.

This is how I explain it to the sellers I meet: “It means that, when we have a conversation, it’s going to stay between you and me and our advisers.

That means all our conversations will be confidential and that in turn means you can be honest with me. Our discussions won’t be shared with anyone else.”

It means you won’t share your discussions with the seller’s competitors, customers, suppliers, or staff.

You won’t share any details on your website, blog or social media posts.

It will demonstrate that you know what you’re talking about and that you’re going to treat the whole thing professionally.

It also shows that you know more than the sellers do and that puts you in a powerful psychological position.

The validity of an NDA is somewhat questionable, but that doesn’t matter.

What matters is that you’ve instigated the conversation. You must make sure you’re the one to raise the issue of an NDA.

It’s all about psychology.

Last year, for instance, I sent the wrong NDA back to an accountancy firm.

One of the accountants rang me and said, “Thanks very much for the NDA, but it looks like it’s for a different project.”

I said, “Oh, I’ve sent you the wrong one by accident.

I have so many discussions going on at the moment…”

It was an accident, but I decided it was an accident worth repeating because it doesn’t do any harm to let sellers know you are considering lots of deals.

It shows that you have money to spend, and you’re looking to find the best terms and best deal.

Make it clear that you’re not the one in a hurry.

If you act as if you’re in a hurry, it will weaken your position.

Behave as if you have all the time in the world to sort the deal out, even if on the inside you’re screaming with frustration.

Never let your desperation to close the deal show outwardly.

Always let it be known that you are evaluating several opportunities.

Opportunities versus Deals

When you’re talking to brokers, use the word ‘opportunities’ rather than deals.

It might seem a little pedantic, but it’s the language used in private equity finance.

Talk About Your Partner

When you talk with a seller, always tell them you have a partner with whom you’ll have to confer. Now, your partner can be your lawyer.

It can be your life partner, who doesn’t have anything to do with the opportunity per se, but you probably will talk about it over dinner. The seller never has to meet this mysterious partner.

Emphasise The Benefits Of The Deal

It’s important that you present your deal in the strongest possible way.

Deferred consideration is not, obviously, appealing, unless you sell the benefits of it.

For example, you could say to the seller something like, “Think of it like this John, for the next three years, you can be in Barbados.

Every month for the next three years, you’ll look at your online bank account, and see that a sum of money has been deposited there.

You’ll never have to step foot in this office again.”

Practice

You’ve must be able to sell it in the strongest possible way to the seller, and that takes practice.

You can practice that at home in front of the mirror.

You need to practice it 20, 30, even 40 times so that when you’re sitting in front of a real seller, it feels natural to say it.

Only by practising it will you become confident and persuasive in your delivery.

It’s a bit like an actor rehearsing their lines so that when they go out on stage for the first time, it’s as if they’ve been doing it their entire life.

Focus on the positives. Say, “Look, there might be someone out there who will come along and write you a big, fat cheque, but your business has been on the market, how long did you say it was?

Fourteen months, and, so far, no one’s done that.

Now, I realise that everyone would like to ride off into the sunset with a big cheque.

We’d all like that, but these days it just doesn’t happen.

“The deal I’m presenting to you, however, has certainty, and it has speed.

From what you’ve said to me so far, certainty is important to you, because you were let down by the other guy.

I understand that speed is important to you too because you don’t want to set foot back in the office from September.

“So, we’ve got to get this tied up, July, August time, which is, well, that’s, like, five, six months away at most.”

You’ve got to think about the things that you can offer and couch them in the very best possible terms.

It might not be the best financial deal, but if you do it right, it will be the most appealing deal to the seller.

The key to all of this is self-confidence, and that comes from practice.

The Expert Advisers You Need For Every Deal

Whether you sell or buy a business, to do so successfully, you need access to a team of people who have the expertise, skills, experience and qualifications that you don’t have.

It is foolish to believe that you can do everything yourself.

By leveraging other people’s talents and time, you can compound your achievements.

You need the following experts in your Deal Team.

Merger & Acquisitions Lawyer

Mergers and Acquisitions is a speciality subject that most business owners don’t use in the day-to-day course of their business.

But merger and acquisitions can involve a range of technical considerations including tax, competition, pensions, and regulations.

An M&A lawyer will advise and guide you through these technicalities to ensure your deal is successful.

Without such advice, it’s likely any dealmaker will flounder.

It’s why having an M&A lawyer on your team is an essential part of your future success as a dealmaker.

Insolvency Lawyer

If you are interested in buying distressed assets, in other words, assets that are on the verge of insolvency, then you also need an insolvency lawyer who understands the latest regulatory requirements around managing corporate insolvent situations.

In recent years, the rules have been tightened, and it is essential that you have expert guidance in this field otherwise you might fall foul of the law and become personally liable.

It’s why you need an insolvency lawyer on your team.

Due Diligence Expert

A due diligence expert will undertake the checking and assessment of the business that you are buying to help you understand its positive and negative aspects.

Having an expert carry out due diligence on your behalf will allow you the opportunity to review the deal without the emotion.

Accountant/Tax Consultant

An accountant will help you structure your portfolio to minimise your tax exposure and lessen your risk.

Your accountant can help you to compartmentalise your companies to make it easy to sell or close them individually in the future.

For example, if one of your portfolio companies underperforms due to a change in consumer behaviour or the economy, you should be able to close it down without adversely affecting other companies within your portfolio.

Your accountant will also help you to structure your affairs to plan for inheritance tax and allow your descendants to benefit from your hard work.

Finance Broker

If you follow the Dealmaker’s Academy methodology of buying businesses without risking your capital, it’s still likely you will need to raise finance.

This means you need to have access to all of the financing possibilities.

An experienced finance broker will be able to guide and help you to find the best source of funding for your particular situation.

HR Consultant

Whether you buy the shares of a business or the assets of a company, you will encounter TUPE (or Transfer of Undertakings (Protection of Employment) Regulations). It involves the transfer of the staff to you.

Part of your restructuring after an acquisition, whether you merge it into your company or keep it as a standalone business, might be to reduce the staff headcount.

Attempting to do this yourself without proper guidance is likely to end in disaster.

An HR Consultant will help you to manage these potentially difficult situations.

The Benefit of Hindsight

An InterviewWith Neville Wright

Neville Wright sold his company Kiddicare to Morrisons for £70 million. Here he reveals what he would do differently given a chance.

“Morrisons said they wanted our website.

They didn’t want the shop; they wanted the operating system—the online ordering system we used.

In hindsight, I should have sold them the operating system.

As it was, they never used it, and they went to Ocado and rented an old system instead.

“They’d spent £500 million in the previous three years trying to get online. I couldn’t understand why because I’d been able to get online in a day. Three years after they bought Kiddicare and after a £176 million loss, they decided to rent Ocado for £217 million.

I thought then we should have kept the shop and sold them the operating system or licensed it to them. It was a far superior system to anything else that was available.

By the time they bought it from us, we were on our fourth-generation website, and we had our own platform.”

How important were your advisers? Did you feel you had a good team around you?

“Yes, I couldn’t have done without them. I never spoke to any of the people who wanted to buy the business. I didn’t have a single conversation with any of them. My team did it all. Three years beforehand, I hired somebody to act as Chief Financial Officer. He was very good with big businesses. So, with him, and our management team, they dealt with it all. I wasn’t involved.”

Did that frustrate you, or were you happy with that?

“It was frustrating, but I was basically out of the equation. They said, ‘You keep out of it.’ But it was just as well because I’d have probably done the deal at £40 million. I would have felt sorry for somebody and said, ‘Here, take it.’”

Any buyer who’d hoped to take you out for a coffee to build rapport with you would have wasted his or her time because your advisers shielded you?

“Yes. I carried out running the business while the team took care of the deal.”

The Traits Of A Successful Dealmaker

The traits of the dealmaker are probably very different from what you expect.

You might think that you must be brash and aggressive like Gordon Gecko from Wall Street or Jordan Belfort from The Wolf of Wall Street.

That’s far from reality.

One of the most effective traits of a dealmaker is the ability to get along with people.

If you want people to sell you their business, you’ve got to be a nice person, so they want to do the deal with you.

Most successful dealmakers are:

Honest.

- Being a successful dealmaker isn’t about screwing people over on deals.

- It’s about buying or selling a business, so both sides get what they want (or as near to it as possible).

Hard working and focused.

- You will need to work in a very focused way on your business.

- In the beginning, you might put in a 35-hour week as you ensure that costs are cut, and improvements are made.

- The amount you work on the business will decrease as things improve.

- You will also need to spend time finding more deals.

Respectful.

- A great dealmaker won’t patronise or insult other buyers or sellers, but make it clear they respect them.

You might think, ‘Oh come on, if the deal’s right, they’ll snap it up regardless of what I’m like.’ That’s not the case. There’s so much emotion when people sell a business.

They want to sell it to people they like. You’ve got to tell them what a great job they’ve done. Okay, they’ve hit a bit of a hard time because of the recession, but that isn’t their fault. Tell them how you can take the business to the next level. You’ll be amazed at how pleased people are that you’re not intending to asset strip their business and close it down.

Good with people.

- If you’re abrasive or patronising, prospective sellers won’t want to deal with you.

- They want to know that you’re going to look after the businesses they have created from scratch.

Decisive.

- Dealmakers don’t spend months deliberating over a deal.

For example, I have someone who can carry out due diligence on any company I’m considering and report back to me within 24 hours on whether it’s worth proceeding. He’ll call me and say, ‘Jonathan, this is something you should be doing’, or ‘Jonathan, walk away, you’re wasting your time on this one.’ It saves me a lot of time. I’m a decisive person, but when there are multiple deals in the pipeline, it helps to have someone else running the numbers for me.

Quick to act.

- When people decide to sell a business, they want to move fast, so you need to act quickly, which means you need to have the right team around you and have the right documentation prepared.

- You need to be able to move quickly through the purchase process because if you drag the process out, the deal can fall over.

There’s something called ‘deal fatigue’. When negotiations drag on endlessly, both parties begin to get exhausted, frustrated and irritated by the process. They begin to lose hope that they will ever reach an agreement. There’s a risk that the deal will collapse, or the seller will decide to consider other alternatives such as putting a manager in place rather than selling it.

Responsible.

- If you’re buying businesses that have staff, and you will be because there’s no point buying a business without staff unless you’re buying its intellectual property assets (IP), you need to have a sense of responsibility.

- People’s livelihoods are at stake. You have to respect that those people have families and financial obligations like mortgages or rents to pay and endeavour to treat them fairly.

- However, you may need to cut overheads by making some of those employees redundant, and it’s much better to do that quickly and respectfully.

The right way of doing this is to use the services of a great HR person who understands what you’re trying to do.

You need someone to whom you can say, ‘I need to reduce the headcount; we need to get rid of “x” number of people, and we need to do it quickly and painlessly. Could you do all the paperwork and make sure there’s no comeback on me. I don’t want any issues. I want this done professionally, and I don’t want anyone to feel they’ve been short-changed.’

I made 70 people redundant from a company I bought and with the help of my HR person, accomplished almost without any issues. The one issue we had was with someone who’d been to a job interview and been offered the job. Bizarrely, he’d been sent an employment contract to sign before he started working there. I wouldn’t offer anyone an employment contract before they’d been with my company for some weeks. I’d want to see how they performed before offering them a contract. But in this case, we had to pay this man for a job he hadn’t even started.

Capable of letting go and delegating.

- This will get easier as you buy more companies because you’ll come to realise that you have to keep your eye on the big picture and allow other people to take care of the day-to-day running of the business.

The Rule Of Six (The 1-5-1 Rule)

We have a rule at the Dealmaker’s Academy called ‘the Rule of Six’.

The Rule of Six says that over an 18-month or two-year period, you buy six businesses.

You do not manage those businesses on a day-to-day basis.

In a 12-month period, you will sell one business, and you will buy one.

So you have six, and you sell one.

You then have five businesses, and you buy one and sell one.

You then hold five and so you buy one and sell one and so on.

That is your Rule of Six.

You always have six cash-flowing assets, and you have a capital event—the sale of a business—every 12 months.

Remember, most people have an event like that once in a lifetime, if at all. They get to retirement age, and there’s nothing to sell.

It’s so very important that you are constantly replenishing your stock of businesses as well.

Buying one business in the way that we describe is very, very easy.

That is no money down, and the purchase is at a price that’s below market value.

It’s very, very simple indeed.

How To Put The Right Corporate Structure In Place For Acquisitions

Corporate structure is the structure of the ownership of the businesses.

Now depending on where you are in your business journey, you may well have started off as a sole trader.

A sole trader sometimes is recommended by accountants for small businesses because it’s tax efficient.

But you can’t operate as a sole trader if you want to buy other businesses.

That’s simply because you do not want to expose yourself if you’re buying multiple businesses because obviously, the risks multiply as well.

I’m going to show you how to de-risk the acquisition.

Get The Lowest Tax Rate

It allows you to take advantage of Entrepreneurs’ Relief, the lowest rate of tax in the UK. It’s just ten per cent and is available to the owners of businesses that have fulfilled certain criteria. For example, the business has been trading for more than 12 months; that you own five per cent or more of the business; and that you’re a director or an officer of the company and so forth.

I want you to have the best corporate structure so that when you sell the business, you can maximise the amount of money you make by paying the most appropriate and the lowest level of tax in the UK. That’s critical.

The next reason why corporate structure is so important is that when you have multiple assets, some might not perform as well as others, and you might want to close them down. You need to do it in a way that won’t affect the other assets.

Also, when you sell one of the assets, you need to maintain the others. If we’re talking about the Rule of Six, and you sell one, you want to be able to maintain the other five without having to untangle that one business from the others.

Why You Need Multiple Bank Accounts

All your businesses are separate entities and must, therefore, have separate bank accounts. It is very important to minimise your personal liability to zero unless, of course, you do something illegal in which case, you’re not going to be protected. Let’s assume that you’re going to play fair and keep on the right side of the law and you’re going to maximise your exit in terms of cash received by reducing the amount of tax that you’re paying.

Don’t Buy In Your Name

You’re also going to have a structure that will be the most flexible and which will allow you to increase and decrease your portfolio in years to come. The key point, number one, is you never, ever, ever, ever, ever buy in your name. You don’t buy a business as Joe Bloggs. It might be Joe Bloggs Limited, but it’s not Joe Bloggs, the individual.

Likewise, you don’t buy in the name of your existing company. For example, if you own a printing company and you want to buy another printing company the new company will be a separate entity to your existing printing company. Why would this be if you intend to merge them? Well, the one that you’re buying might have some nasty, unpleasant things that you do not want to affect your existing business. Instead, you want to keep it separate until you know exactly what you’ve bought. You might decide to merge the good bits and maybe leave the bad bits out.

Special Purpose Vehicles (SPV’s)

Before buying other businesses, you need to set up a special-purpose vehicle. This is a company that you set up for the sole purposes of acquiring your target companies.

You can go to your accountant to set up an SPV and they might charge you £200 or £300, or you can go to Companies House (www.gov.uk/government/organisations/companies-house) and do it yourself. It will cost you about £12.50. It doesn’t have to be complicated. The articles of association that can be adopted are standard.

You can set up an SPV at any time, but it’s better to do it sooner rather than later because Companies House takes a few days to approve the name of a business. Sometimes the name can be rejected which means you have to begin the whole process again.

That’s why having an SPV in the background as a dormant company, ready to go, is a good idea. You can even have several of them if you intend to get into dealmaking in a big way.

The Ideal Corporate Structure

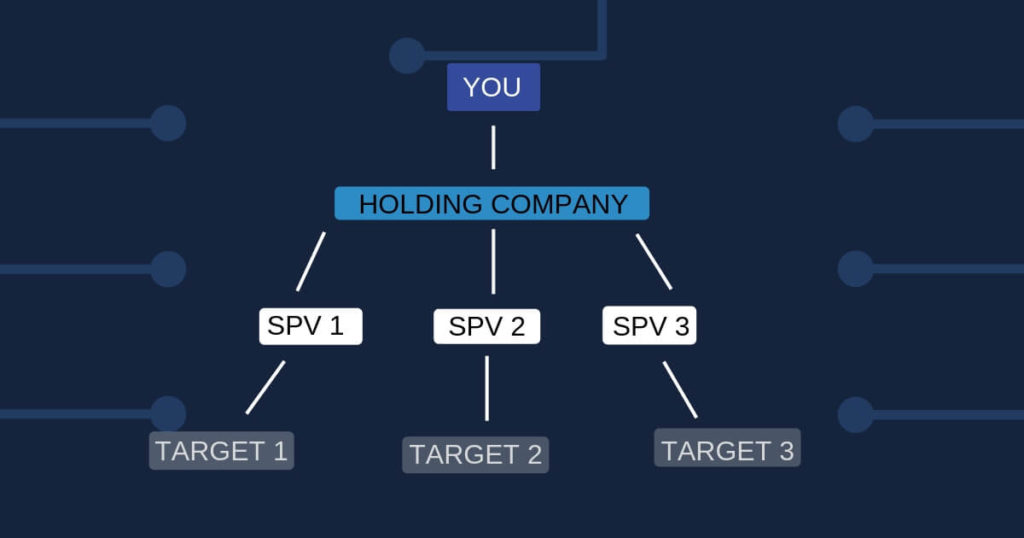

You are the ultimate beneficial owner, and you own a holding company.

Now a holding company is no different to any other company.

You might own 100 per cent of the shares, or it might be split between you and a partner.

If you do have a partner, you need a shareholders’ agreement for the holding company.

It’s important to have a shareholder’s agreement because that company will be very valuable because it will own all the other companies that sit underneath it.

You need an agreement that enables you to be able to resolve problems with the minimum of fuss.

It should explain what will happen if one of the shareholders wishes to leave or sell, or if one of the shareholders wants to buy the other shareholders out, and what happens if there’s a deadlock scenario and you can’t agree on something.

You need to establish who makes the ultimate decision.

There must be a division of responsibilities so that it’s clear who negotiates the deals, and who takes care of the logistics of the day-to-day operations of businesses.

Underneath the holding company sit your special purpose vehicles, your SPVs.

In the image there are three: SPV one has been set up to acquire target one, SPV two has been set up to acquire target two and so on.

You can have hundreds of SPVs.

The people who do dealmaking in a huge way end up with hundreds of SPVs, hundreds of targets and, over the time, those businesses are sold off or closed down.

The key point here is the SPV buys the target.

So the target company is at the bottom of the structure, the SPV in the level above, the holding company above the SPV and then you.

It means you are separated from the target.

This is important because if you’re buying a distressed business, the target might be toxic in some way.

So distancing yourself from the target is advisable.

Let’s consider the shareholdings.

You own 100 per cent or a percentage of the holding company.

The holding company owns 100 per cent of the SPV, and the SPV holds 100 per cent of the target company.

So the SPV, let’s call it SPV1 Limited has bought 100 per cent of the share capital of the target company. SPV1 Limited is owned 100 per cent by the holding company.

You own the holding company.

You might wonder how this works if you’re buying assets rather than shares.

It’s the same process, and the same rules apply.

The key point to remember is that your holding company can own shares in the SPV and this is important because you the individual are not buying what is potentially toxic and which might go wrong.

Your Personal Liability Should Be Zero

What is your personal liability if your target goes wrong?

Your personal liability is a big fat zero.

You do not need or should be concerned about personal liability unless you do something that is illegal.

You need a good lawyer and a good insolvency practitioner if you do need to close down target one so that everything is done legally and properly.

It ensures you aren’t impacted personally.

Remember, the shares in the SPV can be owned by your holding company.

That’s critical.

You have to have the holding company sitting between you and the SPV.

This distances you from anything that might go wrong, and that is critical.

I’m not saying that things will go wrong, but sometimes they do go wrong.

Sometimes, you’ll find that target one has so much HMRC liability in it, or it’s being sued or something similarly bad.

In that situation, you should acquire the asset of target one, move them up into SPV one and then close target one.

You’ll be in the same position, but you’ve cut the string that connects target one and SPV one.

Target one falls away, and as a result, you have all the good stuff in SPV one, and all of the bad stuff is taken care of by the administrator.

That is critical.

It distances you from anything that might go wrong.

Use A New SPV For Each Acquisition

You need to set up a new SPV for each acquisition.

It might seem a hassle to set up a new SPV for each acquisition, but it’s important that you do it anyway.

If you do it directly through Companies House in the UK, it costs you £12.50.

I’m sure it’s about the same amount in other countries.

You don’t need someone to do it for you.

When you set up a new SPV, you separate every one of your acquisitions so that none of them can impact the others.

Removing Risk

Now let’s look at how target one might impact target two or target three.

Let’s say target two, and target three are great businesses and performing well, but target one is failing for some reason.

In that situation, you don’t want target one to affect target two and target three. In this scenario, it won’t happen.

You can hive the assets into the holding company.

So, you have a negative situation in target one, SPV one buys the assets from target one, target one goes into administration.

You might want to distance those assets even more from target one by moving them up into the holding company.

There’s another reason to do that, and it is something positive rather than negative.

Let’s say you’re buying printing companies and you’ve bought three printing companies in the way that I’ve just described.

You have owned the companies for several months and know exactly what you have.

You know what’s good and what’s bad.

The holding company or the assets in the target can be hived up via the SPVs into the holding company.

Now the holding company has all of the good stuff, and the targets can be closed down. You could even close the SPV down.

The holding company has all the assets and, if you’ve combined and merged the businesses, you now have one big business.

Of course, if the targets are in different sectors, you won’t combine them into one big business.

But if you have targets that are in the same sector, such as the three printing companies, you could combine them into one holding company.

At this stage, you’ve made sure that there aren’t any nasties.

You have removed the liabilities.

You’re only moving the customers, the contracts, the equipment and the employees.

Staff always move up: they are protected by law regardless of whether you’re buying the assets or buying the shares.

So everything moves up into the holding company and, as a result, you now have one big printing company that you know is good and can benefit from economies of scale and so forth.

It’s a very, very good business to sell.

When you are moving assets around, you must do it very, very carefully.

The reason is that there is a tendency among people with entrepreneurial mindsets to undervalue assets.

You don’t want assets to be valued at a high price because it will cost you more to acquire the company.

Let’s look at some examples of how this would work.

Let’s say you buy the shares in target one but realise very quickly that because of certain liabilities, the business is never really going to fly in its current state.

You decide you want to buy the assets of the business. SPV one can buy the assets.

How To Value Assets

How do you value the assets? You shouldn’t value them yourself because that valuation could be called into dispute.

So you need to get a valuation done by a third-party valuer.

This is someone who specialises in valuing assets for banks and finance companies (who often hold a charge over assets. They are very skilled at estimating the value of an asset.

Typically, an asset’s value is somewhere between a fire sale (‘We need to sell this today’) and selling to a willing buyer.

Asset valuers tend to be prudent and cautious. They are a little bit like property surveyors because they’re always erring on the side of caution and the side of prudence.

You’ll know that the valuation is probably going to be a sensible one.

So let’s say that SPV one wishes to buy the assets of target one and the valuation has come out at £25,000.

You can then take that valuation to an administrator.

It’s always helpful if the administrator has a recommended valuer.

It means they know and trust one another and you don’t have to do introductions.

So, the administrator accepts that the value of the assets is £25,000.

You pay £25,000 to target one.

That £25,000 goes to pay the administrator and then anything left over is distributed to the creditors, starting with the secured creditors and then moving down the rankings.

By doing that, you will have achieved two things: you’ve acquired the assets and rid yourself of all the unpleasant stuff which might have ended up costing a lot more than £25,000.

The decision about whether you should do this or not depends on how big the nasty stuff is.

If there’s £500,000 worth of HMRC liabilities, for example, buying the assets for £25,000 makes an awful lot of sense because you’ll be saving yourself £475,000.

You can lend the holding company £25,000.

The holding company lends the SPV £25,000, the SPV pays the £25,000 to the target, and the SPV now owes you £25,000.

So as this is a loan, the £25,000 then needs to move back to you over time.

The key thing is that the valuation is carried out by a third party.

Don’t try and do this yourself; it will always be called into dispute.

Who would call it into dispute?

Well, one of the charge holders. HMRC might say “We’re owed £500,000, the assets have been sold for £25,000.

Is that a correct number?”

The administrator can say, “Yes, it is, because the assets were valued by this valuer who’s been in business for the past ten years and has all these accreditations and belongs to these trade bodies.

Here is the valuer’s report that sets the valuation at £25,000.”

It becomes indisputable.

Without that valuation report, it’s possible for the creditor, in this case, HMRC to demand the administrator unwinds the transaction.

The administrator can force you to give back the assets and then sell them at what is considered fair market value.

That’s why you need to get it right from the start.

Why You Need a Debenture

Debenture

noun

A long-term security yielding a fixed rate of interest, issued by a company and secured against assets.

If you lend money to the company, you need to take a debenture over the company.

Before I explain what I mean, let’s go back to our diagram.

You’ve lent £25,000 to the holding company.

The holding company has lent £25,000 to the SPV, and the SPV has paid £25,000 for the target’s assets.

So there has been a loan to the holding company.

The holding company has made a loan to the SPV. You need a debenture over the holding company.

The holding company, therefore, needs a debenture over the SPV.

It’s an interesting situation because you are entitled to security.

Let’s imagine a worst-case scenario, in which something happens to the holding company.

Example Of A Debenture

You are a debenture, a charge holder.

It’s just like holding a mortgage on the holding company.

Two things can happen as a result.

You can appoint the administrator.

An unsecured creditor, let’s say, British Telecom, can’t appoint the administrator because there is a charge holder in place—in this case, that’s you.

Of course, you will appoint an administrator who isn’t going to be unnecessarily aggressive with you.

You’re going to appoint an administrator that maybe you’ve worked with before.

You have a professional rather than personal relationship with the person you appoint.

The second very important thing about holding a debenture is that when the assets of all of the SPVs are sold, the realisation of those assets comes back to you.

So you get your money back ahead of HMRC, ahead of the unsecured creditors and ahead of a second or a third charge holder who might exist.

You secure your position at the front of the queue.

You can appoint the administrator, and you get your money back.

This is what we call ‘de-risking’ a scenario, and as soon as you lend money, you are entitled to a debenture, and your lawyer can do that for you.

It needs to be registered within 30 days at Companies House.

It needs to be done correctly, and you want to get that fixed, so it covers all of the assets of the holding company.

I do know some people lend money to a holding company to secure that debenture.

They’re setting themselves up for success even if everything else fails.

I know this sounds incredibly negative, but it’s a little bit like getting a prenup before you get married.

You don’t want to exercise the prenup, but it’s better to have it there just in case.

It’s a belt and braces approach.

By securing your position in this way, if something does go wrong, at the very least, the money that you lent the business is secured and will come back to you.

It’s information you won’t find in online articles or books.

You can only learn this from people like me who’ve done it and learned what works.

So as first charge holder, you can appoint the administrator, and that is critical.

You need to avoid a situation where there is no charge, and someone else appoints the administrator, and you get an aggressive administrator who takes everything away from you.

You also want the opportunity to buy the assets back.

If buying the assets back is something you want to do then you need to be in a position where you can buy those assets back at whatever the third-party valuer says they are worth.

Now when you come to selling assets, you can sell the holding company sitting there at the top or the individual SPVs.

You’re more likely to sell the holding company if the holding company owns a series of businesses that are in the same sector.

Take our printing business as an example.

Let’s say the holding company owns three, four, five or six printing businesses, then selling the holding company is a good move.

You can sell the individual SPVs, so if we take our Rule of Six, you own six companies, you sell one every year, and you buy one every year.

So you sell one, hold five, buy one, then using the structure, you can sell these SPVs off individually.

The proceeds from the sale of the SPV move up into the holding company.

So the holding company benefits from the sale.

You can sell SPV two right out of the middle, and it won’t affect SPV one, and it won’t affect SPV three and so on.

You can sell them off or close them down or do whatever you want with them.

This structure helps you maximise your efficiency in your sale.

Likewise, you can close individual SPVs as you merge businesses.

Let’s say you have the printing company and you move all the assets, the contracts, the customers up into the holding company.

You acquire the businesses as going concerns and can then close down the SPVs as they are no longer required.

Why would you do that?

Well, well, why wouldn’t you do that?

You have to pay a filing fee every month, some sort of accountancy fee every year, so you may as well get rid of them and close them down.

BUY A BUSINESS – PART 3

In this part of the guide to successful acquisitions and mergers we’ll be looking at the following:

- What lenders want from buyers

- What to do when deals go bad

- More ways to strengthen your negotiating position

- How Neville Wright, founder of Kiddicare, grew the business and made it so appealing to buyers

- More questions to ask a seller in the first conversation

- How much due diligence is required for a deal

- How many UK businesses get sold?

- Why you should make a site visit to a company you’re considering buying

- When to grab a distressed company

- How to get expert help and be a successful dealmaker

What Do Lenders Look For?

When you want to finance an acquisition by borrowing money, what criteria do lenders use to assess your application?

Our finance expert Neil reveals exactly what lenders are looking for.

If we’re looking at a new-start business, then we’re looking at the people behind it.

We’re covered by certain regulations.

We need to do anti-money laundering checks, for instance.

We need to do what we call ‘know your customer’, so we need to prove and verify that you guys are alive, you’ve got a pulse, you’re not convicted terrorists and so on.

We look for security behind you guys at the start of a new business, so we prefer homeowners with equity, but that’s at the very start.